The consulting agency Knight Frank has published a forecast for the growth of residential real estate prices in 25 megacities of the world in 2023. According to the study, the cost of housing will increase the most in Dubai. What will be the increase in percentage terms and what are its reasons - we analyze in the article.

Dubai Leads Luxury Property Price Growth in 2023

According to Knight Frank's forecast, the price of residential real estate in Dubai in 2023 will increase by 13.5%. This is a record figure among the 25 megacities in which the agency monitors and predicts the dynamics of housing prices.

Miami ranks second in the forecast (price growth by 5%). There are several cities in the 3rd position at once: Singapore, Los Angeles, Paris, Madrid, Lisbon and Dublin with a score of 4%.

Negative dynamics in price growth is predicted in Melbourne, Hong Kong, Edinburgh, Vancouver, London and Seoul.

According to Knight Frank's forecast, on average for all 25 metropolitan areas, real estate price growth in 2023 will be 2%.

Next, consider the reasons why Dubai is so far ahead of other metropolitan areas in terms of housing price growth.

Property prices in Dubai in 2022

According to Knight Frank, by the end of 2022, prices for 5-7% are expected to rise in Dubai's main real estate market. Similar dynamics will continue in 2023.

But in the highest price segment, at the end of 2022, there is a truly “explosive” price increase - by 50-60% compared to 2021. In the luxury real estate segment of Dubai, there is a consistently high demand with a shortage of supply. This is one of the key factors behind the double-digit growth in property prices in Dubai.

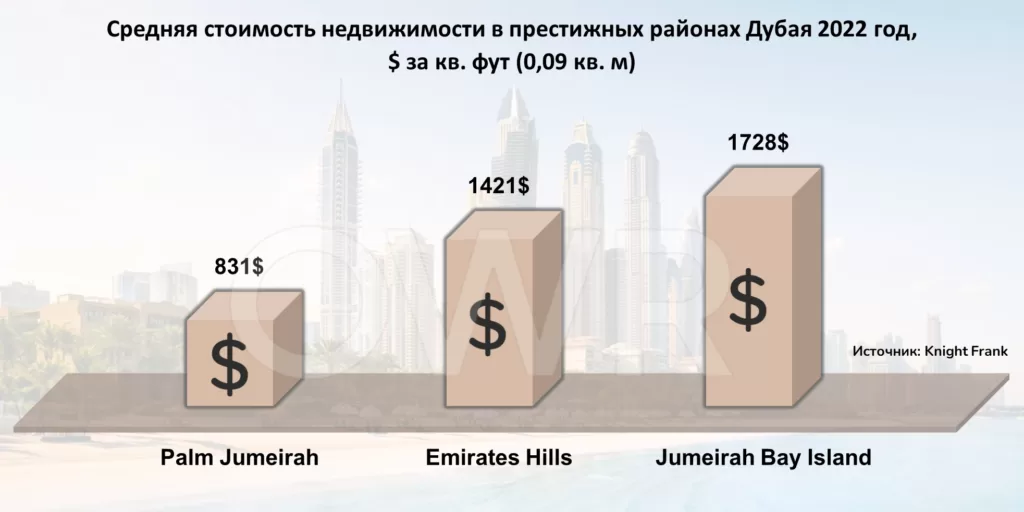

Dubai attracts wealthy people from all over the world as a "heavenly place" with a comfortable tax regime and relatively affordable housing prices. The luxury real estate market in Dubai remains one of the most accessible in the world. Premium homes in this segment sell for around 800$ per sq. foot (approximately 0.09 square meters). In the best areas of New York or London, real estate prices are 4 times higher than in Dubai.

Ultra-luxury real estate in Dubai breaks records

Ultra-luxury real estate (Ultra-Prime) is real estate worth more than $10 million.

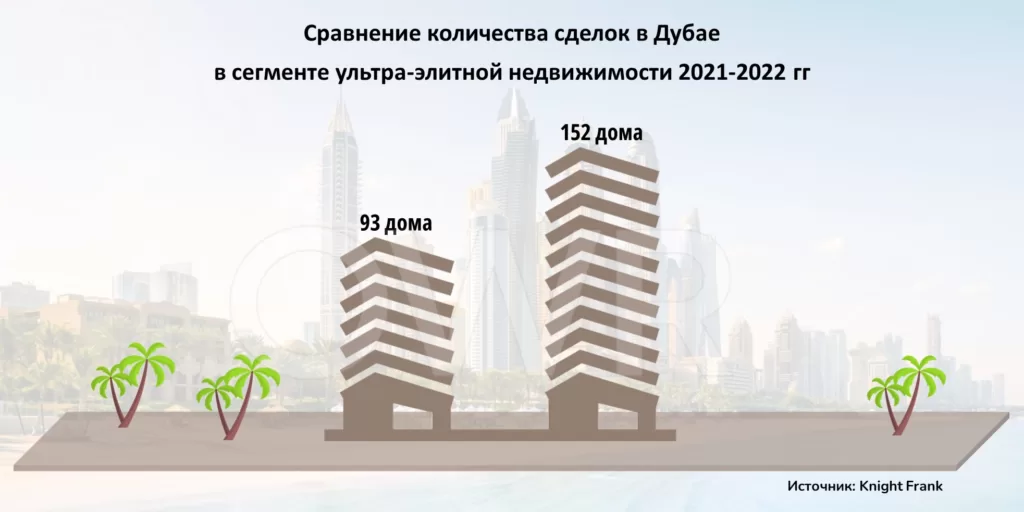

2021 and 2022 were record-breaking years for transactions in the ultra-premium segment. 93 ultra-luxury homes sold in Dubai in 2021. For 9 months of 2022, 152 transactions have already been made in the Ultra-Prime segment.

As you can see from the chart, the number of transactions in the ultra-premium segment is growing rapidly from year to year. Wealthy people from all over the world are interested in buying property in Dubai, despite the rise in prices, and this trend will continue.

In the summer of 2022, another real estate record was broken - the most expensive villa in the history of Dubai was sold. Casa Del Sole, a Palm Jumeirah property from developer Alpago Properties, was purchased for $82.4 million.

Palm Jumeirah, Emirates Hills and Jumeirah Bay Island are three of the most prestigious coastal areas in Dubai, showing record growth in residential property prices. In the years since the pandemic, prices here have roughly doubled.

Offers do not keep up with high demand - including due to limited free space for development. According to Knight Frank, by 2025, developers will build only 8 residential complexes in the above areas. This is clearly not enough in the conditions of excessive demand.

Why do people buy property in Dubai?

After 2014, the Dubai real estate market stagnated due to a glut and falling global oil prices. But in recent years, its rapid revival has begun, which beats all records.

A significant increase in property prices in Dubai was noted in 2021 and continued in 2022. Experts note that the growth started from a “low start” and still has not reached the peak values of 2014.

The following reasons influence the growth of the real estate market in Dubai:

- Positive economic background. By the end of 2022, the UAE economy is predicted to be one of the fastest growing in the world.

- Stability. The dirham exchange rate against the dollar has not changed much over the past years.

- High quality of life. Living on the shores of the Persian Gulf in your own villa with all possible amenities is not a dream?

- The image of Dubai as a “safe haven”, which is little affected by the economic and political crises in Europe and the United States.

- High rental income. On average, it is 6%. In areas where short-term rentals predominate, yields are even higher. Many wealthy people are choosing to invest in real estate in Dubai amid ever-rising housing prices.

- Support measures from the UAE government aimed at attracting foreign capital to the country (tax and visa policy, comfortable conditions for business).

Given the forecast for rising property prices in Dubai, those who plan to buy it should not hesitate to buy. This is a profitable investment that will bring profit to the owner in the future.